Law relating Succession of Hindu Male

Q. 23. Discuss the Rules laid down in the Hindu Succession Act concerning the succession to the property of a male Hindu?

General rules for succession in the case of

males

Section 8 lays down the general rules for

succession in the case of males. Section 8 applies in cases where succession

opens after the commencement of the Act. It is not necessary that the death of

the male Hindu, whose property has to be devolved by inheritance, should take

place after the commencement of this Act.

Classification of heirs

Heirs are classified into four categories:

·

Class I

·

Class II

·

Class III (Agnates)

·

Class IV (Cognates)

Class I heirs

As per the schedule of the Act, the following are class I heirs:

i)

son;

ii)

daughter;

iii)

widow;

iv)

mother;

v)

son of a pre-deceased son;

vi)

daughter of a pre-deceased son;

vii)

son of a pre-deceased

daughter;

viii) daughter of pre-deceased daughter;

ix)

widow of a pre- deceased

son;

x)

son of a pre-deceased son

of a pre-deceased son;

xi)

daughter of a

pre-deceased son of a pre-deceased son;

xii)

widow of a pre-deceased

son of a pre-deceased son.

Until the Hindu Succession (Amendment) Act, 2005, the

Class I heirs consisted of twelve heirs, eight of which were females and four

were males, but after 2005, four new heirs were added, of which eleven are

female and five are male.

By the Hindu Succession (Amendment) Act, 2005 the following

heirs have been added to the list of heirs of class I.

xiii) son of

a pre-deceased daughter of a pre-deceased daughter;

xiv) daughter of a pre-deceased daughter of a

pre-deceased daughter;

xv)

daughter of a pre-deceased son of a pre-deceased daughter; and

xvi) daughter of a pre-deceased daughter of a

pre-deceased son.

Now, class I contains a list of 16 persons. Out of these 16

relations 5 are males and 11 are females. Of them, the son, the daughter, the

widow and the mother are the only four primary heirs and they inherit by reason

of their own relationship to the propositus.

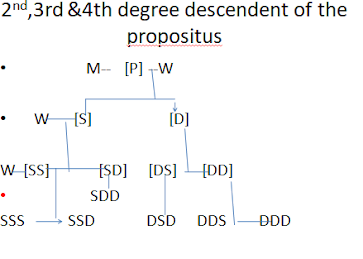

The others are the 2nd, 3rd and 4th degree descendants of the

propositus.

All of them will inherit simultaneously and even if any of them

is present, then the property will not go to the Class II heirs. All Class I

heirs have absolute rights in the property and the share of a Class I heir is

separate, and no person can claim a right by birth in this inherited property.

A Class I heir cannot be divested of his/her property, even by remarriage (1. Section 24, before repeal by

Act 39 of 2005, stood as under:

"24. Certain widows

re-marrying may not inherit as widows. Any heir who is related to an intestate

as the widow of a pre-deceased son, the widow of a pre-deceased son or the

widow of a brother shall not be entitled to succeed to the property of the

intestate as such widow, if on the date the succession opens, she has

re-married." ) or conversion, etc.

Now we will observe who classifies as son, mother, daughter or

widow and what kind of interests they have in the property.

Son & Daughter

The expression ’son’ and daughter can include:-

1.

a natural-born or

2.

adopted or

3.

illegitimate child.

4.

Posthumous son & daughter

(Sec 20. Right of child in womb.-A child who was in the womb at the time

of the death of an intestate and who is subsequently born alive shall have the

same right to inherit to the intestate as if he or she had been born before the

death of the intestate, and the inheritance shall be deemed to vest in such a

case with effect from the date of the death of the intestate.)

The daughter’s marital

status, financial position, etc is of no consideration. The share of the

daughter is equal to that of the son.

but does not include a stepson or daughter.

If a son or daughter

adopted by male Hindu under Hindu adoption& maintenance Act before or after his marriage they are

presumed son or daughter equivalent to natural born son or daughter of

propositus, whereas son or daughter adopted

by female Hindu (wife of the propositus) under Hindu adoption & maintenance Act before the marriage or after the death of

propositus they are presumed as step son or daughter of the propositus.

The eligibility of

illegitimate son of a male Hindu dying intestate has been changed through the

decision of courts. In Lakshmi Bai v. Limbabai (1983 HLR 208),

it was observed that the right of an illegitimate son to get maintenance is not

an adequate substitute for his right to inherit. Even a son born to a person by

marriage which is void under Section 11 or voidable under Section 12 or avoided

under Section 13 of the Hindu Marriage Act would be entitled to inherit as a

son in view of section 16 of the Hindu Marriage Act, 1955. In Rameshwari

Devi v. State of Bihar (AIR 2000 SC 735) the Supreme Court held that

under Section 16 of Hindu Marriage Act, children of void marriage are

legitimate under the Hindu Succession Act, 1956. Hence the illegitimate son is

also entitled to the property of father in equal shares along with the natural

or adopted son.

Widow

The widow gets a share that is equal to that of the son. A widow

would only include a lawfully wedded by a marriage subsisting till such death.

If there exists more than one widow, they collectively take one share that is

equal to the son’s share and divide it equally among themselves. This widow

should have been of a valid marriage. In the case of Ramkali v. Mahila Shyamwati AIR 2000 MP 288, it

was held that a woman who was in a voidable or void marriage, and that marriage

was nullified by the Court on the death of the husband, would not be called his

widow and would not have rights to succeed to his property.

If the widow of propositus, or widow of a predeceased son, or

the widow of a brother has remarried, on the date of succession, even then they

have the right to inheritance.

The word 'widow' mentioned among Class I heirs is lady who was

validly married under the provisions of the Hindu Marriage Act, 1955 and who

has acquired the status of widow by virtue of death of her husband. If her

marriage with person is void under law, on his death she would not get status

of widow under Class I of the Schedule of Hindu Succession Act, 1956; Laxmibai

v. Anasuya, AIR 2013 Kar 24.

Mother

Mother means a natural mother, and adoptive

mother ther are covered under class 1 heirs, Step mother inherits in class 2

heirs entry VI (a) fathers widow.

The mother of deceased male Hindu dying

intestate is entitled to inherit simultaneously with a son, daughter and widow

of the deceased as well as other heirs specified in class I of the schedule.

The remarriage of the mother also does not constitute any bar to her succeeding

to her son.

Class II heirs

The Class II heirs are categorized and are given the property in

the following order:

·

I. Father

·

II. (1) Son’s Daughter’s son

·

(2) Son’s daughter’s daughter

·

(3) Brother

·

(4) Sister

·

III. (1) Daughter’s son’s son,

·

(2) daughter’s son’s daughter,

·

(3) daughter’s daughter’s

son,

·

(4) daughter’s daughter’s daughter

·

IV. (1) Brother’s son,

·

(2) sister’s son,

·

(3) brother’s daughter,

·

(4) sister’s daughter

·

V (a) Father’s father,

·

(b father’s mother

·

VI. (a) Father’s widow,

·

(b) brother’s widow

·

VII. (a) Father’s brother,

·

(b) father’s sister

·

VIII. (a) Mother’s father,

·

(b) mother’s mother

·

IX. (a) Mother’s brother,

·

(b) mother’s sister

Explanation:-

In this schedule, references to a brother or sister do not include reference to

a brother or sister by uterine blood.

Class

II heirs get share only in the absence of any one of the class I heirs. In

class II there are nine entries some of them contain more than one heir.

The

heirs in an entry exclude the heirs in subsequent entries. If there are no

heirs in entry I, those in entry II take and if there are no heirs in entries I

and II those in entry III are entitled and so on. Heirs in the same entry take

simultaneously and not one after the other

Father:

The

father is made a class II heir under the Act and is excluded by class I heirs.

The father occupies the first position in the class II heirs, if there are no

heirs of class I then the property of the deceased goes entirely to the father

despite the existence of other heirs of class II.

Under

the word 'father' may be considered the natural father, the adoptive father and

the step father. A natural father in ordinary parlance includes the father of

an illegitimate child, that is the putative father, but under the scheme of

inheritance outlined in this Act, the putative father has no right of

inheritance.

An

adoptive father would succeed to the estate of his child in preference to the

natural father for by adoption the child severs all his or her connection with

his or her natural family. The adoptive father has the same rights as a natural

father, but where both exist it is the adoptive father who would succeed to the

estate of his deceased adopted son.

A step

father is not an heir at all whereas a step mother is an heir under class II

(father's widow).

Brother:

Brothers

may be divided into three kinds:

i)

the natural brother,

ii)

the step or the

half-brother; and

iii)

the uterine brother.

The word brother, as used in this schedule

means only the natural brother and the brothers related by half blood i.e. the

step brothers. A uterine brother will not be a brother within the meaning of

this entry in view of the explanation to the schedule.

The

position allotted to the brother is in set II of class II-heirs and he succeeds

in the absence of class I heirs and in the absence of the father, he shares

along with the sisters and the children of the son's daughter equally.

Sister:

The position

of the sister is akin to that of the brother and a sister may be a natural

sister, a step-sister or a uterine sister. 'Sister' means only the natural

sister and sister related by half blood i.e. step sister. A uterine sister will

not be a sister within the meaning of this entry in view of the explanation to

the schedule. In the absence of class I heirs and in the absence of the father,

she shares along with the brother and the children of the son's daughters

equally.

Step-mother:

Unlike the step father, a step-mother is an

heir under entry VI (father's widow) in class II. Her remarriage does not

disqualify her from inheritance.

Class III heirs--Agnates

This consists of the agnates of the deceased. Class III heirs

only inherit the property when none from the earlier classes gets the property.

An agnate is a person who is related to the intestate only

through male relatives. An agnate can be a male or a female.

Rules of preference among agnates

·

Each generation is referred to as a degree. The first degree is

intestate.

·

Degrees of ascent mean ancestral or upwards directions.

·

Degrees of descent means in the descendants or downward

direction.

·

Where an agnate has both ascent and descent degrees, each has to

be considered separately.

·

An agnate having a descent degree will be preferred over the one

having an ascent degree.

·

When two agnates have ascent and descent degrees, the one having

a lesser number of ascent degrees will be preferred.

Class IV heirs -- Cognates

A cognate (Class IV) is someone who was related to the intestate

through mixed relatives, in terms of sex. For example, an intestate’s paternal

aunt’s son is his cognate, but his paternal uncle’s daughter will be an

agnate.

Therefore, to sum up it can be said that the property of the

Hindu male devolves in the following manner:

·

First, to the heirs in Class I.

·

Second, if there exists no heir of Class I, then it goes to

Class II heirs.

·

Third, if none from the Class I or II exists, then it goes to

the agnates (Class III).

·

Fourth, if no one from the earlier three classes exists, then it

goes to the cognates (Class IV).

Sec 9. Order of succession among heirs in the Schedule.-Among the heirs specified in the Schedule, those in class I shall take simultaneously and to the exclusion of all other heirs; those in the first entry in class II shall be preferred to those in the second entry; those in the second entry shall be preferred to those in the third entry; and so on in succession.

Sec 10. Distribution of property among heirs

in class I of the Schedule. The property of an intestate shall be

divided among the heirs in class I of the Schedule in accordance with the

following rules:-

Rule 1.

The intestate's widow, or if there are more widows than one, all the widows

together, shall take one share.

Rule

2.-The surviving sons and daughters and the mother of the intestate shall each

take one share.

Rule

3.-The heirs in the branch of each pre-deceased son or each pre- deceased

daughter of the intestate shall take between them one share.

Rule

4.-The distribution of the share referred to in Rule 3

(i)

among the heirs in the branch of the pre-deceased son shall be

so made that his widow (or widows together) and the surviving sons and

daughters gets equal portions; and the branch of his predeceased sons gets the

same portion;

(ii)

among the heirs in the branch of the

pre-deceased daughter shall be so made that the surviving sons and daughters

get equal portions.

Sec 11. Distribution of property among heirs

in class II of the Schedule. The property of an intestate shall be

divided between the heirs specified in any one entry in class II of the

Schedule so that they share equally.

Sec 12. Order of succession among agnates and

cognates.-The order of succession among agnates or cognates, as the case

may be, shall be determined in accordance with the rules of preference laid

down hereunder:

Rule

1.-Of two heirs, the one who has fewer or no degrees of ascent is preferred.

Rule

2.- Where the number of degrees of ascent is the same or none, that heir is

preferred who has fewer or no degrees of descent.

Rule

3.-Where neither heirs is entitled to be preferred to the other under Rule 1 or

Rule 2 they take simultaneously.

Persons disqualified

from heirs

after the amendment,

disqualification of heirs has been classified as:

·

Sec 25 murder

disqualified

·

Section 25 of

the Act disqualifies a murderer from inheriting the property of the person whom

he murdered. He is treated as non-existent and is not considered a part of the

line of descent (Nirbhai Singh v. Financial

Commissioner, Revenue, Punjab & Ors., 2017). A murderer

under the Section also includes a person who aids or abets such a crime.

·

Sec26 converts descendent Disqualified

·

Section 26 of

the Act disqualifies a person or his children born after conversion, who

converts from the Hindu religion to any other religion. The only condition upon

which his descendants are eligible to inherit is that they must be Hindus at

the time of succession. Section 27 further

gives the effect of disqualification and mentions that in case of any

disqualification, the property would be inherited considering that the person

disqualified died before the intestate.

Comments

Post a Comment